First Holidays…

Is this your first holiday season since the separation or divorce where you’ll have to spend part of it without your children? It’s tough, and the first year is usually the hardest. But it doesn’t have to be all bad. It will simply be different. Here are a few tips to...

Are All Mediators the Same? Understanding the Different Styles of Mediation

When couples choose mediation for their divorce, they often assume all mediators offer a similar experience. In reality, there are three distinct styles of mediation, each with its own approach, goals, and outcomes. The type of mediation your professional is trained...

Rethinking a “Fair” Divorce Settlement

Once divorce becomes a real possibility, your thoughts probably jump straight to the future. The fear sets in quickly: I can’t afford to live on my own. How much of my income will I have to give up? Am I going to end up broke? There’s usually a flood of unknowns, both...

Common Money Mistakes in Divorce – And How to Avoid Them

Divorce is emotionally overwhelming, and it’s easy to make financial mistakes when you're under stress. But the choices you make now will impact your future. Here are four common money mistakes people make during divorce and how to avoid them. 1. Underestimating...

Here are five wonderful things about life after divorce:

1. Rediscovering "Me Time": You finally have time to focus on yourself—no more juggling everyone else’s schedules! Dive into hobbies, pamper yourself, or just enjoy the peace of doing absolutely nothing. 2. Freedom to Redecorate: Want to turn the spare room into a...

Can a Divorce Mediator Truly Remain Neutral?

Yes, a divorce mediator can remain neutral because they are trained to understand and consider the needs of both parties. Mediators help each person address their concerns, such as child custody, property, finances, and other important issues. They guide the couple...

Essential Steps to Consider Before Deciding on Divorce

Most relationships begin with the excitement of falling in love, dreaming of a future together—maybe with a couple of kids and a dog, creating the perfect picture of a happy family. However, what people rarely imagine is what happens if that love, respect, and...

Top 5 Priorities When Your Divorce is Finalized

FINALLY! After an emotional roller coaster, you receive that 8 ½ by 11 manila envelope with your divorce decree signed by the judge. You are officially single again. Whether you choose to celebrate or mourn, remember that there are still important tasks to take care...

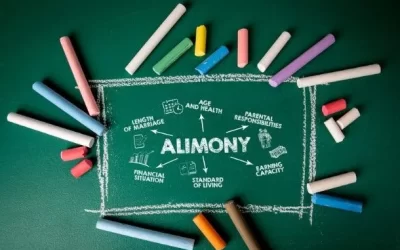

Determining the Right Amount of Alimony

Many couples going through a divorce understand that some amount of spousal maintenance or alimony is necessary, but they often don't know how much or for how long it should be paid. Most attorneys will rely on your budget figures, but in my experience, these numbers...

Deciding to Stay or Leave: Making that hard decision

It probably comes as no surprise that individuals who ultimately decide to divorce had their first thought about that possibility more than a year before it actually happens, and often many years before. Even with early signs, the decision to dissolve a marriage is a...

Respectfully, I Want a Divorce

When it comes to divorce, half of the people involved will hear the news, while the other half will deliver it. Let's begin with what you should avoid doing! Many people handle this poorly. You can't predict how your spouse will react, especially if infidelity is...

Top 3 Financial Tips to Prepare for Your Divorce

Divorce can really mess with your mind. Trust me, I've seen it happen. The smart, organized woman you once were can turn into an emotional, confused mess. You try hard to stay strong, but you know this is not going to be one of your best moments. You want to sit down,...

The Top 3 Most Costly Divorce Settlement Errors

When facing a significant life decision like divorce, consider what you find more valuable: someone who reassures you by saying nothing needs to change, or someone who presents the hard truths directly? I believe there's a shortage of divorce professionals who are...

Financial Guidance for Men Navigating Divorce

What should a man do? You might have seen that there are many services aimed at supporting women through a divorce. This often happens because men are more likely to have managed the finances during the marriage, leaving women needing extra support. However, this...

Thriving in Retirement: Navigating Life After Gray Divorce

As we embrace the 21st century, one noticeable trend has become increasingly common: Baby Boomers are divorcing at twice the rate compared to previous decades. With longer life expectancies, our perspectives on divorce are shifting. While the rate of increase may have...

First Holidays…

Is this your first holiday season since the separation or divorce where you’ll have to spend part of it without your children? It’s tough, and the first year is usually the hardest. But it doesn’t have to be all bad. It will simply be different. Here are a few tips to...

Are All Mediators the Same? Understanding the Different Styles of Mediation

When couples choose mediation for their divorce, they often assume all mediators offer a similar experience. In reality, there are three distinct styles of mediation, each with its own approach, goals, and outcomes. The type of mediation your professional is trained...

Rethinking a “Fair” Divorce Settlement

Once divorce becomes a real possibility, your thoughts probably jump straight to the future. The fear sets in quickly: I can’t afford to live on my own. How much of my income will I have to give up? Am I going to end up broke? There’s usually a flood of unknowns, both...

Common Money Mistakes in Divorce – And How to Avoid Them

Divorce is emotionally overwhelming, and it’s easy to make financial mistakes when you're under stress. But the choices you make now will impact your future. Here are four common money mistakes people make during divorce and how to avoid them. 1. Underestimating...

Here are five wonderful things about life after divorce:

1. Rediscovering "Me Time": You finally have time to focus on yourself—no more juggling everyone else’s schedules! Dive into hobbies, pamper yourself, or just enjoy the peace of doing absolutely nothing. 2. Freedom to Redecorate: Want to turn the spare room into a...

Can a Divorce Mediator Truly Remain Neutral?

Yes, a divorce mediator can remain neutral because they are trained to understand and consider the needs of both parties. Mediators help each person address their concerns, such as child custody, property, finances, and other important issues. They guide the couple...

Essential Steps to Consider Before Deciding on Divorce

Most relationships begin with the excitement of falling in love, dreaming of a future together—maybe with a couple of kids and a dog, creating the perfect picture of a happy family. However, what people rarely imagine is what happens if that love, respect, and...

Top 5 Priorities When Your Divorce is Finalized

FINALLY! After an emotional roller coaster, you receive that 8 ½ by 11 manila envelope with your divorce decree signed by the judge. You are officially single again. Whether you choose to celebrate or mourn, remember that there are still important tasks to take care...

Determining the Right Amount of Alimony

Many couples going through a divorce understand that some amount of spousal maintenance or alimony is necessary, but they often don't know how much or for how long it should be paid. Most attorneys will rely on your budget figures, but in my experience, these numbers...

Deciding to Stay or Leave: Making that hard decision

It probably comes as no surprise that individuals who ultimately decide to divorce had their first thought about that possibility more than a year before it actually happens, and often many years before. Even with early signs, the decision to dissolve a marriage is a...

Respectfully, I Want a Divorce

When it comes to divorce, half of the people involved will hear the news, while the other half will deliver it. Let's begin with what you should avoid doing! Many people handle this poorly. You can't predict how your spouse will react, especially if infidelity is...

Top 3 Financial Tips to Prepare for Your Divorce

Divorce can really mess with your mind. Trust me, I've seen it happen. The smart, organized woman you once were can turn into an emotional, confused mess. You try hard to stay strong, but you know this is not going to be one of your best moments. You want to sit down,...

The Top 3 Most Costly Divorce Settlement Errors

When facing a significant life decision like divorce, consider what you find more valuable: someone who reassures you by saying nothing needs to change, or someone who presents the hard truths directly? I believe there's a shortage of divorce professionals who are...

Financial Guidance for Men Navigating Divorce

What should a man do? You might have seen that there are many services aimed at supporting women through a divorce. This often happens because men are more likely to have managed the finances during the marriage, leaving women needing extra support. However, this...

Thriving in Retirement: Navigating Life After Gray Divorce

As we embrace the 21st century, one noticeable trend has become increasingly common: Baby Boomers are divorcing at twice the rate compared to previous decades. With longer life expectancies, our perspectives on divorce are shifting. While the rate of increase may have...

Exploring the Benefits of Mediation: Tips for Successful Preparation

Many individuals prefer to steer clear of court appearances, especially when dealing with divorce. In such situations, opting for mediation can be a wise initial move. Mediation facilitates discussions between you and your spouse, aiming to reach a fair and agreeable...

Unlocking the Secrets: Deciphering Your Divorce Settlement

You've reached the end of the road. Your divorce is finalized, and it's time to look ahead. You've weathered the storms of tears and anger, and now you're facing a future that's uncertain. It's common to feel stuck in this transitional phase, and some may even revert...

Is Your Divorce Attorney a Team Player or Solo Act? Unveiling the True Partner in Your Legal Journey

In 2015, Netflix debuted a documentary called "Divorce Corp," shedding light on the concerning realities of abuse, collusion, and corruption within the Family Court System. This documentary prompts an important question: How can individuals safeguard themselves in...

Divorce Survival Guide: How Keeping the House Could Drain Your Wallet Dry!

Going through a divorce can turn your world upside down, leaving you feeling lost about your life and what comes next. Many people naturally want to hold onto familiarity by staying in the family home. However, it's important to realize that this decision could end up...

Decoding the Mystery of QDROs: Do You Really Need One and What Does it Involve?

Decoding the Mystery of QDROs: Do You Really Need One and What Does it Involve? You and your spouse have almost finished settling your divorce when your attorney or mediator drops unexpected news: you need something called a QDRO. And guess what? It's going to cost...